As part of this project, lasting from 2016 to 2018, GENConsult was consulting a custodian and depositary, with many UCITS and AIFMD clients, on its operations and internal processes, specifically relating to risk measures, regulatory reporting, and fund monitoring.

A key challenge is how to communicate with customers (funds, or fund managers in this case), about what is to be monitored and reported and by whom. Because of the complexity of regulations, most customers do not automatically agree with the custodian how certain risks are to be measured, or even what some regulatory terms mean precisely.

This creates risks and conflicts which have to be managed. Here is just a very small sample of gems in regulation, which lead to a mismatch what a client, a depositary, a regulator, and an investor may think certain terms mean:

Leverage

In UCITS

- For Schemes using the Commitment Method, Leverage is equal to “Global Exposure” (another defined term in UCITS)

- For Schemes using any of the VaR approaches, Leverage is equal to the sum of notionals of FDIs.

This means, for example, that the former will include “Efficient Portfolio Techniques” (like borrowing, repos, and reverse repos), while the latter will not. It also means that the former will give a sense of real market risk (some kind of “effective” exposure), while the latter will not. Both coexist happily within UCITS, and only one applies in each case.

In AIFMD

- In the Gross Method, Leverage is “exposure” divided by NAV, with “exposure” being the sum of (i) the absolute values of the $-delta of each and every derivative (FDI) position, (ii) the absolute of the market-value of each short position (icnluding FDIs!), plus (iii) the difference between the sum of the market values of all long positions and the NAV, if such difference is positive. (This is not how it’s defined! This is what you find out after putting many pages of many documents together and working out what it all amounts to).

- In the Commitment Method, Leverage is also “exposure” divided by NAV, but exposure is measured quite differently. It’s also a more sensible measure. It’s also a much more complicated measure to compute, and we shall not get into it here.

So in UCITS the word “Leverage” has two meansing simultaneously. There are two Leverage numbers for each portfolio.

In Plain English

Leverage is the amount of money you did borrow, plus the amount of money you would have had to borrow, plus the assets you did borrow, plus the assets you would have had to borrow, to produce the financial risk profile your portfolio has, when implementing the same financial risk profile without the use of derivatives.

What’s the problem?

There are many issues stemming from the above:

- First, the plain English version is most similar to the AIFMD Commitment Method (and one must presume that this is the intent behing the commitment method)

- The plain English version is actually also close to the UCITS Commitment Method, but the UCITS and AIFMD Commitment Methods are described totally differently from each other! It appears that the AIFMD wording tried to re-write the letter of the UCITS wording, without changing the spirit. The difficulty now is to decide: why was it changed? Was it simply intended to be a better description of the same thing, or was it an improvement of the actual thing, and therefore different? Try as you might, it’s so complex, you will not find a conclusive answer, so you have to decide your own interpretation, and then apply it consistently (and of course be open with the regulator what your interpretation is and why).

- In UCITS, if youre scheme uses any of the VaR methods, the definition of Leverage is very different from the plain English meaning. In practice this means that not only fund investors are easily confused by the correct and precise wording in offering documents (for example when it comes to limits on leverage), but much worse fund managers sometimes think they have defined risk limits in the offering documents in a different way from what they actually wrote down! This problem is real and pervasive, and it’s to be expected when a term deviates so much from its use in common language. This makes it difficult for a depositary to onboard such clients, as it’s impossible (sometimes) to convince them that they’ve been in breach of their own restrictions most of the time, simply because they didn’t understand their own restrictions!

Hedging

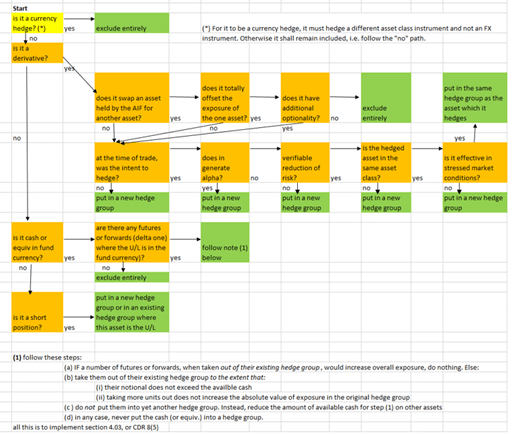

Another difficulty is to decide when is a hede a hedge, for the purpose of exposure calculations. It’s a very complex decision-tree:

and — wouldn’t you believe — the decision tree is exactly the same for UCITS and AIFMD, even though the way the regulations are worded is almost completely different! You won’t find that decision tree in the regulations. Instead, it’s the GENConsult condensation of what all the combinations of lengthy regulations and guidance notes amount to.

Now you can automate it.Without that analysis, you are going to do everything manually, and you are going to make mistakes, and you are going to have inconsistencies in your approach. Also, you may not be able to explain to your clients why you disagree with their calculations….